The past several years have proved that the retail arena is packed with intense competition, and like its neighboring products, the retail movement of consumer electronics is subject to constant shifts in consumer behavior and changing trends, as demand and preferences move with the economic climate and innovation in that field. That being said, 2022 provides a unique standpoint to observe such trends, as current events in the United States deal a challenging hand to many subdivisions within the consumer electronics industry.

The Post-pandemic Laptop Market

Despite a relative lack of eye-opening innovation and the proliferation of alternative devices in America the laptop market is still very much afloat, largely due to the needs of businesses, the work from home scenario, online classes, gaming sector, and the flourishing IT industry. The availability of high speed internet as well as newly adopted policies by many organizations that allow individuals to bring their own devices has greatly incentivised the purchase of high performance, cross functional laptops across several industries- most recently, media and graphic design, as freelance work in these spaces grows. Even outside of work and studies, advanced gaming laptops are popular amongst millennials and are expected to drive the market upwards, especially as newer, more cross compatible games are introduced.

During the thick of the pandemic, however, traffic to laptop product pages grew, while conversion rates plummeted from 3% to 1.5%. This, coupled with the fact that tablets are eating into laptops’ and desktops’ market revenue has meant that laptop shipments were decreasing and the average selling price fell accordingly. Tablets also have a higher stocking freshness rate (a statistic that indicates the percentage of products newly added within a selected time range) but with inventory issues, shortage of components, and fluctuating surges in demand infiltrating the market, stock replenishment rates have fallen significantly across the board, and have been cited as a reason for drops in conversion rates over the years.

60% of all laptop shipments worldwide can be credited to the top 3 players in the market: Lenovo, Dell, and HP. Factors such as prompt post sales support, professional marketing approaches, and (quite notably) competitive pricing have helped them consistently rank as the top three sellers both in the U.S. and globally- with Apple following close behind. Holding its place as top in the market after edging past HP in 2018, Lenovo in 2021 held a 24.7% share of the PC market with 82.1 million PCs sold. HP remains a formidable competitor holding 21.8% of the PC market in 2021, with 74 million systems shipped, a 9.8% increase from 2020. Dell too has shown significant growth, with 59.3 million sold in 2021, an 18% increase from the previous year.

According to Apple Insider, by the end of 2021, Apple had shipped a total of 341 million units (Macs, Macbooks, and workstations combined). The company claims that the pandemic boosted their sales of laptops and notebooks- but since Apple has not officially shared data regarding its laptop shipments since 2018, the majority of statements regarding its market share and exact revenue are projections.

Of all retailers in America that stock these laptops, Walmart boasts 13 times as many brands as its closest competitor- According to our own latest findings, 330 distinct brands are stocked at Walmart while second-in-line Target only offers in the range of 25.

Additionally, our product life cycle analysis shows that the best time to catch a discount for laptops in the USA is around the holiday season in December. That’s in contrast with mobile devices, which benefit from the largest average price cuts early in the year. Note: as offices and universities reopen, offering bundles that include free or discounted backpacks with the purchase of laptops could help further incentivize a customer to choose your product over your competitors. High quality shockproof and water resistant bags are seen as a non negotiable must-have to many laptop users!

Mobile Devices Have the Highest Category Freshness

Regardless of when you purchase your phone, our data suggests that mobile devices have the highest category freshness. Simply put, over the course of 3 months, 76,000+ products could be stocked in the mobile category while laptops and related accessories may only circle 31,000+.

The Intelligence Node Product Lifecycle Dashboard actually calculates this in real-time for multiple products across retailers and industries, and can use this data to provide actionable insights such as determining how long an average fresh product maintains its initial discount, which in the mobile category is a brief 5.15 days.

With the proliferation of high speed internet and ease of access to 5g smartphones becoming more commonplace, the market for smartphones is steadily growing post pandemic with 2021 showing the largest YoY growth in the smartphone market since 2015. High performance phones are now readily available, much more affordable, and once again in demand- and these insights are clearly represented in their sales, with the total number of smartphone users in the States crossing 298 million as of 2021.

The market leaders of this sector as of Q2 2022 are Apple (with a market share of 48%), followed by Samsung (30%), both of which are titans in the consumer electronics industry with their respective operating systems (iOS and Android) found on nearly all U.S. smartphones. Lenovo, inclusive of Motorola, holds 9% and OnePlus 1%, with all other brands making up the remaining 12%. Tech junkies in 2022 are on the lookout for the Nothing phone and its performance post release- while it is not set to be available in the USA this year, eyes are on this upcoming brand to see how it compares to its competitors, especially the OnePlus. Tablets and e-readers are also experiencing healthy upward market trajectories.

Further, as an interesting note, studies show that the smartphone boom may have resulted in camera sales facing a massive categorical markdown- with digital camera sales dropping by 87% from 2010 to 2020.

Home Entertainment Provides the Highest Average Discounts

Specifically in regards to home entertainment systems, the number of active households is expected to include 31.5 million by 2026, with household penetration expected to hit 23.3 that same year. Additionally, the majority of worldwide revenue lies in the States, where product prices range from several hundred USD to the tens of thousands (meaning those high discounts can be a serious boon). “Home entertainment” can be a fairly ambiguous umbrella term. For more specificity: home audio systems and theater systems are witnessing a rise in sales.

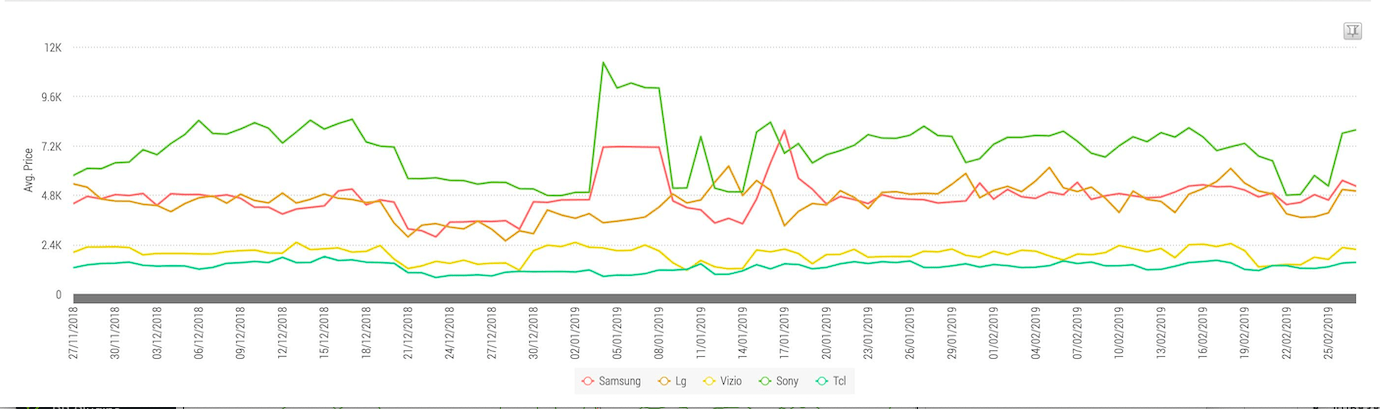

As for actual televisions themselves, Intelligence Node data has found that over 300 distinct TV brands are available in the U.S. market, offering discounts on 4K televisions averaging three times more than those on HD products. Samsung sits comfortably atop that leaderboard, followed by LG, Sony, and then VIZIO.

This graph of home entertainment price changes from November to February indicates a positive relationship between high prices and overall fluctuation, with relatively expensive Sony’s prices oscillating considerably and cheaper options VIZIO and TCL fairly stable.

Gaming consoles in this year are yet to witness the dust settle on the whirlwind release of the PS5, which is still cited to be the best performing console in terms of dollar sales as of July 2022. Its devoted fan following still tracks updates and releases for connected games and controllers along with any other gaming accessories: all this despite supply chain issues and component shortages.

The Final Word: Deep Dive Data is Crucial to Retail Success

That’s why Intelligence Node offers technological solutions to give you a leg up on the competition. For instance, the 360°Pricing™ tool gives intelligent insights such as price elasticity and inventory levels for most products in the eCommerce space.

So, while most online resources will tell you the obvious in that digital cameras are on their last leg, our detailed customizable dashboards can tell you that DSLR cameras have the greatest discounts in November while point-and-shoot cameras are cheapest in December. Or, which fans and cooler accessories have experienced the most price fluctuation over the last 3 months.

With Intelligence Node tools at your disposal, you can confidently make data-informed market evaluations in the consumer electronics industry and well beyond.

Learn More : What's Hot 2022: A Guide to Consumer Buying Trends & Retail Tech Predictions