The Increasing Relevance of Search in Modern Retail

How Search Impacts Online & Offline Buying Behavior

Benefits of Share of Search vs Share of Voice

How to Calculate Share of Search for Your Brand

Factors That can Influence Search Results

Creating a Holistic Brand Footprint Across the Digital Shelf The Increasing Relevance of Search in Modern Retail

In a digitally driven retail universe where every virtual journey begins with a search- it comes as no surprise that ‘Share of Search’ is emerging as one of the top performance metrics in eCommerce. Share of search is a simple representation of a brand’s visibility via organic search compared to other brands within the industry. It is a unique indicator of brand health, and marketers have even found that it can represent 83% of a brand’s market share. This is a clear reflection of digitally-driven consumer behavior in 2023, as tech-savvy shoppers now form the majority of worldwide consumers, and have adapted to the oversaturated digital retail space with ease. These shoppers are hyper-aware of market trends, price-conscious, and can navigate the digital shelf within minutes, hunting for discounts, popular items, and brands in just a few clicks.

Today, top retailers and globally-recognized brands dominate SERPs (Search Engine Results Page), often occupying the first several individual search results. Further, the first page of search results accounts for 95% of traffic, so if your business can’t secure its spot in the ranks, it may risk falling behind. Research suggests that by 2027, 70% of all US shopper journeys are set to be digitally influenced- a stat that implies a sharp upturn in the importance of online search across marketplaces and search engines. Thus, to remain competitive in the long run, a comprehensive organic search strategy is a critical key to success.

Read more : Intelligence Node’s Digital Shelf Analytics as a Brand Essential

How Search Impacts Online & Offline Buying Behavior

From the consumer’s perspective, search is, and has always been crucial. One quick search can be used to discover new and trending products, interact with other shoppers via reviews and ratings, or even to verify the quality, payment, and buying options available to them. Search is thus used for a myriad of reasons, empowering users to navigate the saturated digital shelf with ease, and enabling them to access relevant product information to make informed buying decisions.

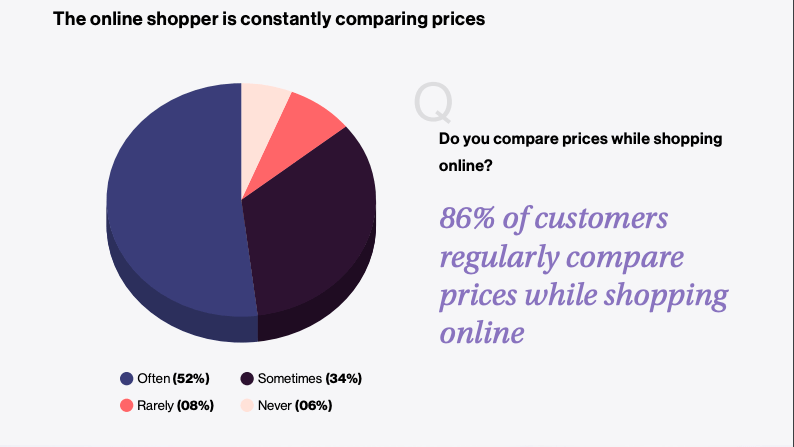

Offline shopping, or brick-and-mortar shopping, does not operate on the same core elements of shopping on the digital shelf. Here, stores are the medium of discovery for new brands, and shelf placement and offline pricing strategies influence buyer experiences. However, in today’s uncertain economic climate and with a large number of American shoppers newly identifying as ‘price sensitive’, search plays a key role in allowing such shoppers quick and easy access to relevant product data and pricing data. Here, search empowers users to quickly identify reviews, alternative products and pricing options as they shop, to ensure they always find the best deals for them, and derive the best value for their purchase.

Benefits of Share of Search vs Share of Voice

Simply put, a brand’s ‘share of search’ indicates how often the brand is mentioned in online searches in comparison to competing businesses. Share of voice, on the other hand, can vary in exact definition. Metrics such as share of search, share of voice, market share, and brand awareness are often used in similar contexts, but hold distinct outputs and use cases for different teams within a business.

Share of Voice

Share of voice is most commonly described as a company’s percentage of media spending in relation to overall media expenditure for the category in the market. It focuses primarily on paid visibility and media spending, and does not take organic search and visibility into consideration. A common illustration of this metric is the following example: if a retailer spends $1 million on advertising, but $10 million was spent overall in the industry, the retailer’s share of voice is 10%.

Thus, in order to calculate a brand’s share of voice, marketers must possess the exact figures spent by competing brands across all channels in the same retail category. This information may be difficult, if not impossible to acquire, and available data may not be accurate. This has made the metric unreliable and difficult to utilize in recent years, largely due to the proliferation of competitors, media channels, and advertising making accurate data inaccessible to marketers. Further still, it has been found that 96% of consumers do not trust ads, limiting the usability of the metric in many retail categories.

Share of Search

Share of search is significantly easier and quicker to calculate, as it relies solely on real searches by real audiences, and a tool with the capability to track them. Such search volume data is freely available on Google’s Keyword Planner, ensuring highly reliable, accessible, and accurate output. While share of voice may indicate the level of investment a brand has made into paid advertising, it does not help businesses analyze the volume of consumers who are actually engaging with their brand online. Share of search is a highly controllable metric in comparison, and is universally applicable– even for small brands, or major retailers who do not invest in traditional advertising, such as Trader Joe’s or Primark. Share of search also enables businesses to analyze competitor visibility.

A deeper understanding of a brand’s share of search allows marketers to allocate precise budgets to organic search strategies. This is key to avoiding excessive spends on SEA (Search Engine Advertising) campaigns and PPC (Pay per Click) while maintaining high discoverability online.

How to Calculate Share of Search for Your Brand

A brand’s share of search is calculated by deriving the number of searches received over a set period of time. This figure is then divided by the total number of searches for all competitors within the industry. Often derived as a percentage of total searches, the final number reveals the percentage of search queries the brand receives in comparison to the rest of its competitors online.

Google Trends

Google trends is a free tool utilized by marketers and brands worldwide, can be used to analyze keyword search volume trends. It is the simplest means to derive a brand’s share of search, and focuses on dissecting the share of brand search terms between competitors in an industry. One major limitation of this tool is that it cannot display how much of a given category keyword a brand owns. To extract a brand’s share of search, input up to 5 competing brand names into Google Trends to instantly summarize the ‘search volume’ data received and calculate share of search for the brand in question. This option yields the quickest, simplest results despite limitations in depth and further analysis of search performance. This leaves marketers blind to the intent behind these searches, and cannot further inform organic search strategy.

SEO Tools

SEO tools such as Semrush, are also utilized to derive a brand’s share of search. Such tools provide more detailed data to work with. Similar to Google Trends, share of search can be extracted by inputting relevant brand keywords and following the same formula: dividing the search volume of the brand in focus by the total volume of searches among competitors. SEO tools also allow users access to the performance of multiple category keywords. Many advanced SEO solutions have position tracker tools and a wide range of metrics to derive brand visibility. This means that relevant keywords can also be used to gauge the position a website ranks for among specific search terms. This added capability of analyzing product exploration keywords and intent-driven search volume acts as a benefit for a detailed share of search analysis.

Factors That can Influence Search Results

To build and maintain a healthy share of search for a brand, marketers must continuously review and optimize multiple factors that contribute to the brand’s performance on SERPs. These include:

Product content enrichment

Today, displaying high quality images, detailed descriptions, and active reviews and ratings sections, are basic elements of a modern retailer’s website. Users who are unable to find relevant product information will quickly click away in search of more comprehensive content. To remain competitive, top retailers include interactive features that compel users to engage with the website longer. Thus, displaying additional details such as materials/ingredients, packaging information, or even AR try-ons and 360 degree HD imagery can boost not only engagement rates and clicks, but enhance consumer experience and conversion rates.

Accurate item availability indicators

Unavailable/out-of-stock products automatically drop a website’s search ranking, as modern SERPs are optimized to display the most relevant results first. Without reliable inventory and assortment management strategies, brands are liable to lose clicks due to stocking issues.

Pricing and promotions

Many shoppers today search for products with the intent of identifying the best deals and discounts. Displaying ongoing promotions in high discoverability spaces on your website, and optimizing them for search, enables shoppers to quickly find deals and drive purchase decisions. Furthermore, competitive pricing is essential to rank as high as possible, as higher price tags that are not at par with competing brands will automatically fall behind.

Positive reviews & ratings

As audience expectations evolve, and customers become more decisive about their retail spending, positive reviews have become a highly influential factor in purchasing decisions. Low ratings or no visible ratings can automatically impact rankings as well, as the volume of engagement and reviews can affect where your brand’s products are placed on the digital shelf.

SEO optimization

Finally, it is critical for retailers in 2023 to consistently track trending keywords and search terms to ensure PDPs reflect relevant ongoing trends. Utilizing the full scope of SEO optimization features across brand websites ensures every image, description, and webpage counts towards improving search rankings. These terms and specifics are prone to change over time, and dedicating resources to ensure strong SEO value can be make or break for digital retailers.

Creating a Holistic Brand Footprint Across the Digital Shelf

Visibility goes hand in hand with success in modern retail. In an effort to keep up, many major brands have made strides in digital retail by investing in innovative, unique, and compelling concepts to draw attention to key products. For example, Nestle’s custom KitKat Chocolatory and MnM’s personalized selections were novel, customizable gifting options unique to the brands’ online experiences. Pepsico’s bundle based digital store as well was a fresh, engaging way for shoppers to purchase their favourite snacks and try new products. These huge retailers are making efforts to stay relevant by creating omnichannel and virtual experiences that set them apart from competitors- and add intrigue to their online channels. Young, DTC startups often look towards trends and viral opportunities for visibility, tapping into pop culture discourse and memes to increase brand awareness and sales.

Evidently, 21st century retail is multifaceted- making its metrics of success diverse, along with the strategies to achieve them. Without online visibility and recall, businesses cannot hope to achieve engagement, clicks, and conversions. Thus, to ensure your retail business stays competitive in a saturated market, turn to modern, data-driven software solutions. Intelligence Node’s record breaking accuracy and refresh rates deliver actionable, timely insights via AI-powered algorithms and automated processes to transform retail strategy- learn more by booking a demo today.