Introduction

Online retail businesses have to a lot to worry about and fight against but perhaps nothing quite screams danger as the financial aspect. Shallow pockets and thin resources, overwhelming competition from both big brand-name businesses and and smaller online retailers, declining sales and so on – these are just some of the challenges faced on a regular basis. Thus, it’s only natural to try and squeeze an extra dollar here and there out of the existing financial operations. Naturally, there are some quick fixes that turn things around but these are all short-sighted solutions. Any online retail store built on a sound financial basis knows better than this but not every business has the benefit of that insight.

So, what can you do?

With growing pressure to generate better sales and minimize costs to increase profits, you must center on creating more revenue from your existing operations while continuing to add new ones to the fold. Easier said than done, right? Not necessarily as there are some things to consider in order to improve your retail store’s financial operations. Don’t worry, we’ll let you in on what you need to do so you can do right by yourself. Ready? Let’s go.

1. Forecast your future

To get a good sense of how your money is flowing around and what the future holds in that regard, what you need is a financial forecast. Being prepared for the future endeavors, especially in the case of growing businesses, allows the power of foresight to know what to expect and how to deal with unfavorable movements, which are all but bound to happen in the tense retail market. A financial forecast is one of the best practices for small and medium retail online businesses to gain meaningful insights on both a monthly or weekly basis. It will allow them to identify peaks in expenses in time of their most selling periods and show where income will be the highest. There is a good, accurate and fast way to do it, which brings us to our next point…

2. Leverage technology by using retail analytics

If there is one thing that makes life on this planet much easier, it’s technology. Running your financial operations can also be much easier if you utilize it the right way. In the case of the aforementioned forecast, the process itself could be as simple as paper and pencil or a digitized version of it in the form of an Excel sheet. Or, you can opt for retail analytics software to get a more formal and accurate result. Naturally, two of the three methods are time-consuming and largely inefficient but are also deemed as more financially acceptable solutions. Looking long-term, they are also not sustainable, something that modern tech puts maximum effort in.

On its own, technology is an investment with significant proportions. However, what you get in return far surpasses the investment-to-benefit ratio. For instance, transferring your modus operandi on cloud simplifies and streamlines the whole business operation and puts in on a higher level. By “upgrading” to cloud technology in the form of retail analytics, you make your data open for multiple users from different locations to access the data and work on it. The software helps minimize the risks of human assumptions that can trigger margin loss, overstock situations, and missing the boat on market trends. That directly impacts the efficiency while reducing labor costs. And that’s just one example out of the many features retail analytics software possesses.

In retail, it’s imperative to know as much about the market as possible. In that regard, you can leverage technology to use data analytics to improve operational performance across all channels. Having insights into store-level demands in real time makes sure your bestselling items remain in stock. Optimize your pricing by keeping a close eye on competitive pricing and discount strategies. From the marketing standpoint, gaining visibility into promotional performance can help you adapt your strategy, while also benefiting your forecasting and recognizing various market movements like seasonal trends, hot items and different opportunities to maximize revenue.

Ultimately, this translates to a win-win scenario – more satisfied customers and reduced cost for you. The bottom line here is that using technology can help your retail store in a variety of ways, from improving productivity by automating a bunch of manual tasks to helping you better oversee your inventories and everything in between. Speaking of inventory…

3. Perform inventory segmentation

Because of the large scope and competitiveness of the retail market, a business is better off segmenting its inventory. Why? Because an inventory is not just a statistical overview. Looking at it, you want to gain insights into your sales. Does your cash flow revolve around products that don’t sell on a regular basis? Can you use that money to create better profits through other better-selling items? There could be lots of money tied up in inventory without actual good reason. It’s all about meeting customers’ demand and needs.

Because the way online stores function, much of their data insights are broken into pieces, spread across the organization. Collecting that data into a single, comprehensive view allows better financial results because you get a scoop on things like growth, consumer trends and else. By uniting and integrating all of its data into a single source, an online retailer is set to reap the benefits of knowing its most important competitive performance metrics, as well as make better overall business decisions. And faster, too, as nothing beats on-the-spot insights.

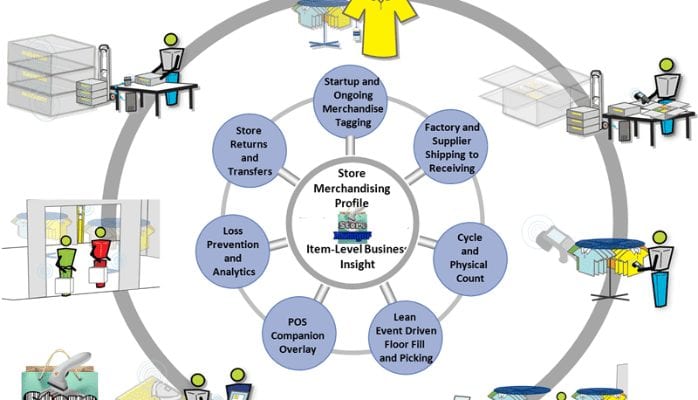

An example of inventory management in a retail store

Source: LinkedIn

Conclusion

Retailing is as much about local mindset as it is about thinking globally, with the whole world as a selling stage. As such, it provides ample opportunity and company, which is where handling of your financial operations comes into play. A retail business simply must understand its financial numbers and what they are saying about the state of the business. Along with financial statements, business analysis and intelligence are key to making that happen. Going the modern tech route allows you the dissect all the financial angles of your operations, while also providing you with the benefit of time to have other bright ideas that can improve your business’ standing. That way, you will be able to devise an accurate business plan and hit all the right spots.